Powering transactions with AI

Effortlessly integrate financial services into your platform with powerful Ai driven solutions. Enable instant collections, smooth payouts, and automated reconciliations while maintaining complete control.

Banking that works, one code at time

Effortless transactions, automated flows, and smarter banking, all through powerful APIs

API banking connects businesses to financial services through programmable interfaces. It enables automated reconciliations, and real-time fund movements without manual intervention. With hassle-free integration, businesses can optimize cash flow.

- Instant Transfers

- Automated Reconciliation

-

Custom Reporting

-

API Documentation

-

Easy Integration

-

Fraud Prevention

-

Fund transfers

-

Instant payments

-

Custom Reporting

-

API Documentation

-

Easy Integration

-

Fraud Prevention

-

Fund transfers

-

Instant payments

Diverse API choices

API banking offers a range of solutions to integrate financial services into business platforms. It allows for faster transactions, more control over funds, and automated processes. With the power of APIs, financial institutions can unlock new opportunities for innovation.

Payment Collection API

Simplify Payments, Maximize Efficiency

Easily collect payments via APIs integrated into your platform. Automate the entire collection process, reducing manual tasks and ensuring funds reach the right accounts without delays.

Payout API

Fast, Secure, Reliable Payouts

Manage payouts effortlessly with our API, providing businesses with fast, secure, and reliable transactions. Ensure your beneficiaries receive their funds on time without manual intervention or errors.

Reconciliation API

Match Transactions, Save Time

Automate the reconciliation of payments and receipts to reduce human error and time spent on manual processes. Our API helps you maintain financial accuracy and ensures your records are always up to date.

Unlock precise control with AI powered API

Streamlined integration, smarter banking, as well as faster transactions through our reliable and pioneering API solutions

Our API solutions bring simplicity and precision to your financial operations, ensuring quick, secure transactions. With effortless integration into your platform, we enable automated payments, reconciliations, and tracking. Empower your business to handle banking operations effortlessly.

Powerful banking features

Our API banking platform offers advanced features designed to streamline financial processes.

Hassle-free Onboarding.

Onboard merchants and clients with minimal steps. Streamlined processes enable faster setups, allowing your business to start transacting in no time.

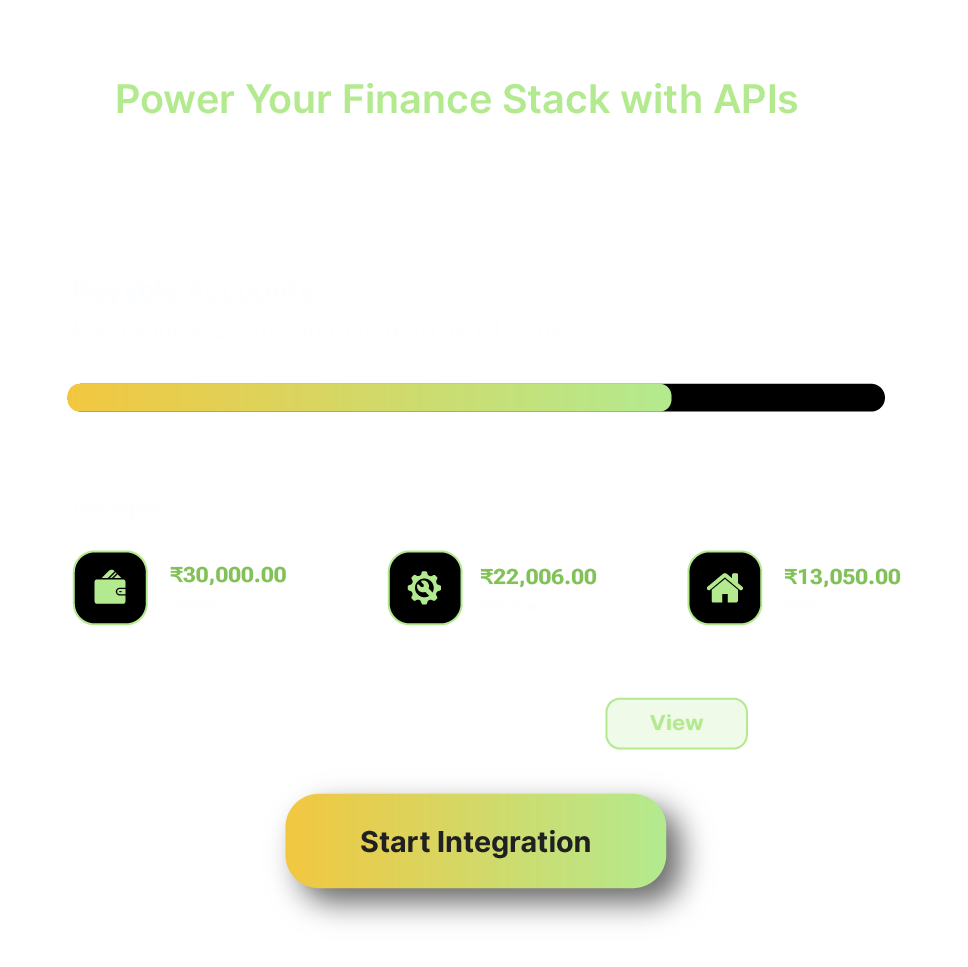

Advanced Analytics.

Gain insights into your financial data with advanced reporting and analytics. Make data-driven decisions that enhance business performance and optimize growth.

Customizable Workflows.

Tailor workflows to match your business requirements. Adjust settings to suit your operational needs, ensuring an efficient and personalized banking experience.

Dynamic Settlements.

Automate and optimize your settlement process with dynamic features that adjust to business needs. Enjoy flexible scheduling for faster fund transfers.

Transaction History.

Access detailed transaction records instantly, helping with audits, reviews, and financial analysis. Keep a comprehensive history for full transparency and control.

API Monitoring.

Monitor API performance and transaction status with real-time updates. Quickly detect issues for smooth operations.

Answering curious API queries

01. How does AI enhance API banking services?

AI strengthens API banking by automating workflows and improving transaction accuracy. It enables real-time data processing, reducing delays and enhancing financial efficiency. Smart analytics provide deep insights, optimizing cash flow and decision-making. This results in a responsive banking experience.

02. How secure is API Banking?

API banking ensures high levels of security by using encryption, secure access protocols, and regular audits to protect data and transactions. It eliminates the risks of manual handling and reduces human errors. Security features are designed to prevent fraud and unauthorized access.

03. How can I integrate API Banking?

Integration of API banking is simple and can be done through an easy-to-follow setup guide. Developers can access the API documentation for integration instructions and test environments. Once integrated, businesses can start utilizing features like payments, collections, and reconciliations.

04. What types of businesses can use API Banking?

API banking is suitable for all types of businesses, from small startups to large enterprises. It helps businesses streamline their financial processes, whether they operate in e-commerce, services, or any other industry. The flexibility of API banking allows for easy adaptation to various business needs.