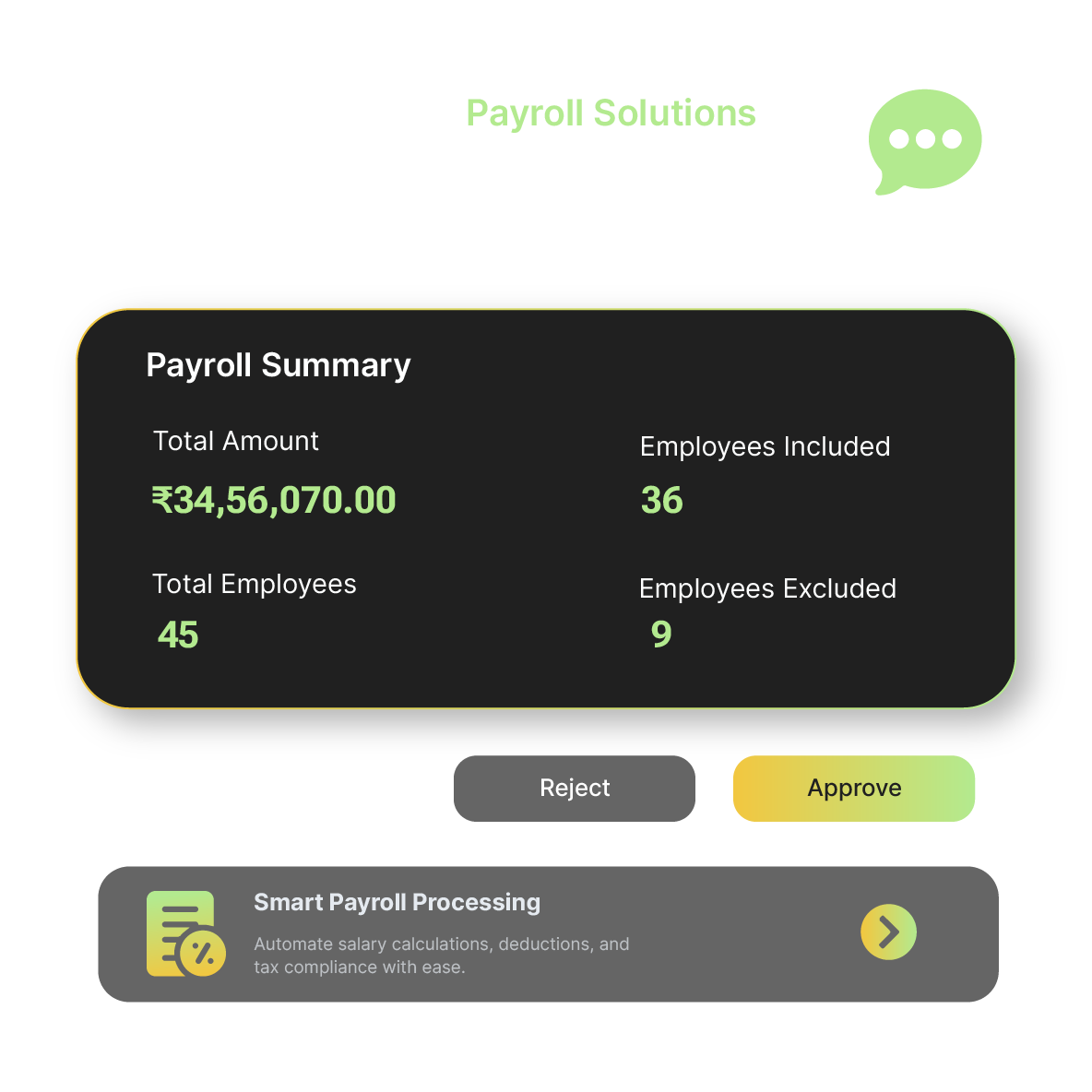

Start payroll in moments

Set up your payroll effortlessly with just a few simple steps that are easy to understand.

Built for new ventures

Startups need payroll that’s fast, flexible, and hassle-free. Our platform streamlines salary disbursements, tax calculations, and compliance, so you focus on growth. Payroll shouldn’t slow you down, it should keep up with you.

Join us and experience smart payroll solutions designed for growing startups

Manage payroll effortlessly with automation, accurate calculations, and timely payments. Stay compliant while handling salaries, and taxes with minimal effort.

Every startup moves fast, and your payroll should too. Our tailor-made system ensures smooth processing, reducing manual work and costly errors. From employee onboarding to final payments, everything runs like clockwork. Let payroll work for you, and not the other way around.

Scaling your business is easier when payroll runs effortlessly. Automate payments, track deductions, and stay compliant without extra stress. Spend less time on payroll and more time building your startup.

Reliable and bespoke payroll solutions tailored for your businesses

Handle payroll with ease, accuracy, and compliance in every pay cycle. From salaries to tax deductions, everything runs smoothly with our assistance.

Payroll shouldn’t be complicated or time-consuming, especially when your focus is growth. Our platform automates calculations, ensures timely salary disbursements, and keeps records organized for hassle-free management. Stay compliant with built-in tax calculations and flawless reporting.

Tailored payroll for your needs

We adapt to your business requirements, offering customizable payroll solutions for any size.

Streamlined for you

We provide the flexibility to meet diverse payroll needs for any business. Whether you’re a small startup or an established company, we have a solution for you. From tax compliance to employee benefits, we’ve got you covered.

-

Employee Onboarding.

Easily onboard new employees with automated documents, tax forms, and payroll setups. Our platform collects required details, so you don’t have to. Save time while at the same time reduce errors by automating the onboarding process. New hires are up and running within minutes.

-

Payment Flexibility.

Set custom pay schedules that work for your business, weekly, bi-weekly, or monthly. Our system supports a variety of payment structures, from salaried employees to contractors. Ensure employees are paid on time, every time, without hassle. Payroll flexibility allows you to focus on growth.

-

Tax Compliance.

Stay compliant with tax regulations without the headache of manual calculations. Our system automatically calculates federal, state, and local taxes for every pay period. Ensure accuracy with up-to-date tax rates and deduction handling. Let our platform manage tax complexities so you don’t have to.

-

Benefits Management.

Easily integrate benefits such as health insurance and retirement contributions into payroll. Automate deductions, track employee enrollments, and ensure timely benefit disbursements. Streamline your benefits administration to improve employee satisfaction. You don’t need manual tracking any more.

We’ve got answers for payroll queries

01. How do I set up payroll?

Setting up payroll is simple with our platform. First, create your account and input your business details. Then, add employee information, including salaries and tax rates. Once everything is set, you can run payroll effortlessly and ensure employees are paid on time without fail.

02. How does the tax calculation work?

We automatically calculate taxes based on federal, state, and local rates. We ensure that all applicable taxes, including income, social security, and others, are accurately deducted. Tax rates are updated regularly to comply with the latest regulations. This removes the burden of manual calculations.

03. Can I adjust payment schedules?

We allow you to customize payment schedules based on your business needs. You can choose weekly, bi-weekly, or monthly pay cycles for your employees. You can also set up flexible pay periods for contractors or part-time workers. Adjusting schedules is simple and doesn’t disrupt payroll processing.

04. How do I manage employee benefits?

You can integrate employee benefits such as health insurance and retirement contributions directly into payroll. The platform automatically deducts the correct amounts from employee pay and handles the disbursements. It tracks employee enrollments and ensures timely benefit contributions.